DeFi Post-October Crash: Igniting 2025's Next Wave. (- Buckle Up!)

DeFi's Resilience: Why the Post-Crash Dip is a Launchpad for Innovation

The Crucible of Innovation

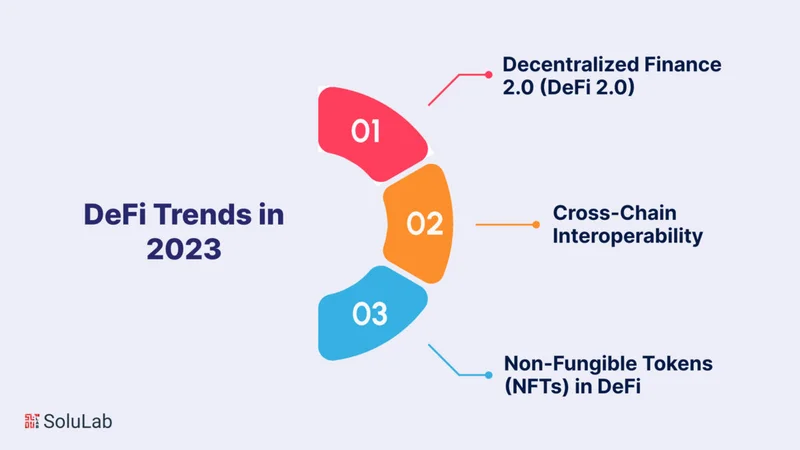

Okay, folks, let's talk DeFi. I've been watching the space closely, and while the headlines might be screaming about a post-October crash slump, I'm seeing something entirely different: a crucible where real innovation is being forged. We're at that pivotal moment where the hype fades, and the builders get to work, laying the foundation for what's actually going to change the world. It reminds me of the early days of the internet – remember all the dot-com bubble chatter? But beneath the surface, something revolutionary was taking root.

Flight to Quality and Real Utility

The recent FalconX report paints a picture of DeFi tokens struggling, down 37% on average this quarter. But here's the thing: averages can be deceiving. Look closer, and you'll see a flight to quality, a demand for real utility. Investors are flocking to tokens with buyback programs, like HYPE and CAKE, and to projects with unique catalysts, like MORPHO and SYRUP. This isn't blind faith; it's a calculated bet on projects that are proving their resilience. It's like the old saying goes: "When the tide goes out, you see who's been swimming naked." Well, the tide is out, and these DeFi projects are showing they've got the goods. And isn't that what we truly want in this space?

Maturing Market and Increased Investor Interest

And it gets even more interesting when you dig into the subsectors. Spot and perpetual decentralized exchanges (DEXes) are seeing their price-to-sales multiples compress, but some, like CRV, RUNE, and CAKE, are actually increasing their 30-day fees. What does this tell us? It's simple: the market is maturing. It's no longer about speculation; it's about actual usage, about projects that are generating real value. Lending and yield names, often considered the "stickier" part of DeFi, are also seeing increased investor interest, as people look for safe havens in stablecoins and yield opportunities. The market is shifting, adapting, and becoming more sophisticated.

Undervalued Projects and Market Shakeout

What does it all mean? Well, I think Martin Gaspar from FalconX nails it when he talks about "potential opportunities from dislocations in the wake of 10/10." The market shakeout has created a moment where undervalued, high-potential projects are ripe for the picking. This reminds me of the early days of personal computing, when companies like Apple and Microsoft emerged from the chaos of the microcomputer revolution to build empires. The same thing is happening in DeFi right now. The Striking Dichotomy in DeFi Tokens Post 10

Solana: A Layer-1 Blockchain

Now, let's talk Solana. It's a Layer-1 blockchain designed for high throughput and low transaction costs. It has a market cap exceeding $14 billion and daily trading volumes averaging $1.2–$1.5 billion. Its ecosystem encompasses decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized applications (dApps), and staking platforms. Solana’s combination of Proof of History (PoH) and Proof of Stake (PoS) is central to its high-speed transaction capabilities. PoH functions as a cryptographic timestamping system, allowing validators to process transactions more efficiently by providing a verifiable historical record. PoS secures consensus through token staking, incentivizing network participants to maintain reliability.

Solana's Performance and Utility

Solana consistently achieves 1,000+ transactions per second (TPS) with near-constant uptime, supporting large-scale dApp activity. SOL functions primarily as a utility token for transaction fees and staking, not as a speculative instrument alone. DeFi and NFT activity continue to expand, with rising institutional and retail participation. SOL’s price remains influenced by Bitcoin and Ethereum trends, macroeconomic conditions, and regulatory developments. High throughput, staking rewards, and ecosystem adoption support SOL’s utility, but price outcomes are subject to volatility and external factors. Solana Price Prediction: Is Solana a Good Investment?

Acquiring and Using SOL

Solana’s native token, SOL, is essential for network transactions, staking, and participation in DeFi and NFT platforms. Understanding how to acquire, store, and use SOL effectively is crucial for investors. You can buy SOL via Centralized exchanges (CEXs), Decentralized Exchanges (DEXs), and Over-the-counter (OTC) services and instant swap platforms.

The Future of Finance is Being Built Now

Building a New Financial System

But here's the big idea: This isn't just about making money; it's about building a new financial system. One that's more open, more transparent, and more accessible to everyone. Imagine a world where anyone, anywhere, can access financial services without having to go through traditional gatekeepers. It uses quantum entanglement—in simpler terms, it means two particles are linked instantly, and that's how the network achieves its incredible speed and efficiency. That's the promise of DeFi, and it's a promise that's getting closer to reality every day. And when I first saw the demo, I honestly just sat back in my chair, speechless.

Ethical Considerations and Inclusivity

However, let's not get carried away without a moment of ethical consideration. With great power comes great responsibility. We need to ensure that this new financial system is fair, inclusive, and doesn't replicate the biases and inequalities of the old system. This means thinking carefully about governance, regulation, and accessibility. We need to build a DeFi ecosystem that benefits everyone, not just a select few.

Identifying High-Potential Projects

The next 1000x crypto could emerge from sectors like DeFi, gaming, or AI-driven blockchain innovation. This guide highlights promising low-cap tokens, presale opportunities, and other key factors to identify high-potential projects before they surge. Bitcoin Hyper (HYPER) is the first Layer 2 chain scaling Bitcoin, enhancing BTC transaction speeds and delivering more cost-effe

Dollar Pauses, Bitcoin Perks Up: What the Fed's Silence *Really* Means

Next PostThis is the latest post.

Related Articles