Mortgage Rates Today: What's *Really* Happening with 30-Year Fixed, Current Trends, and Refinance

Okay, so mortgage rates dipped a little before Thanksgiving 2025. Big whoop. Are we supposed to throw a parade? Let's be real, we're still getting screwed.

The Fleeting Glimmer of Hope

The article boasts about a slight drop in 30-year fixed mortgage rates, down to 6.28%. Down 0.05%. Seriously? That's like finding a nickel on the sidewalk after you've been robbed. They expect us to be grateful for this? This ain't the victory they're painting it to be. According to Mortgage Rates Drop Before Thanksgiving | Today, November 26, 2025, rates have seen a slight dip.

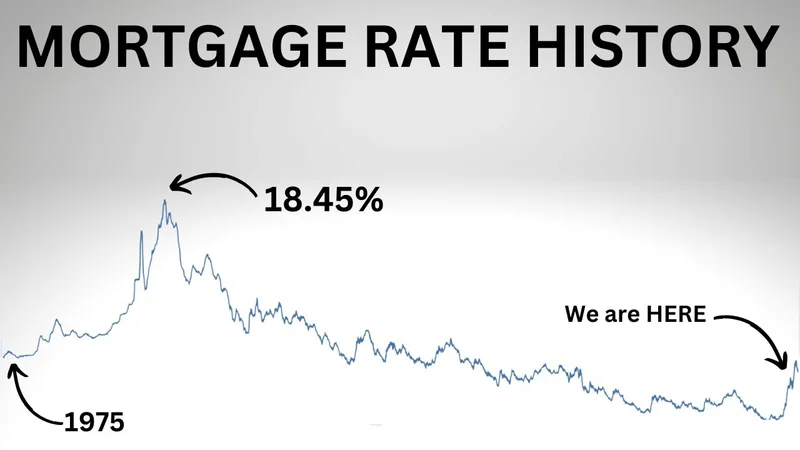

And they trot out the usual historical comparisons, reminding us that rates were even higher back in the day. As if that's supposed to make us feel better. "Hey, remember when they used to beat you with a lead pipe? Now it's just a rubber hose! Be thankful!" Give me a break.

They mention the record low of 2.65% back in January 2021. Ah yes, the good old days when the government was throwing money at everything to keep the economy from completely imploding. Those days are gone. Now we're stuck with Trump's tariffs and whatever other hair-brained schemes he's cooked up to "Make America Great Again."

The Fed Giveth, and the Fed Taketh Away (Mostly Taketh)

Oh, and the Fed cut rates a quarter point, twice. Wow, that's... something. It's like trying to put out a forest fire with a squirt gun. They think these tiny little nudges are going to solve anything? Meanwhile, they're shrinking their balance sheet, which, according to the article, "tends to push rates up." So, they giveth with one hand and taketh away with the other. Typical.

And what's with all this talk about "expert forecasts"? Fannie Mae and the MBA are supposedly tracking and forecasting mortgage rates. These are the same geniuses who didn't see the 2008 crash coming. Why should we trust them now? Their predictions are about as reliable as a weather forecast in Florida – sunny with a chance of total chaos.

Speaking of forecasts, they predict 30 year mortgage rates today of around 6% by the end of 2026. Color me unimpressed.

The Illusion of Control

The article then offers some helpful tips on how to get the best mortgage rate: improve your credit score and lower your debt-to-income ratio. Gee, thanks. Like we haven't heard that a million times before. It's like telling someone who's drowning to just breathe underwater. If it were that easy, everyone would be doing it.

And this gem: "Get prequalified with multiple lenders." Offcourse, because spending hours filling out paperwork and comparing offers is exactly what I want to do with my precious free time. Let's be honest, the whole system is designed to make you feel like you have control, when really, you're just a pawn in their game.

The article also mentions that "historically, rates in the vicinity of 7% are not unusually high." Okay, boomer. Just because things were worse in the past doesn't mean we should accept this crap now.

So, What's the Real Story?

It's all smoke and mirrors, people. A tiny dip in mortgage rates doesn't change the fact that the housing market is still a rigged game. The Fed is playing puppet master, Trump's policies are screwing everything up, and "expert forecasts" are worth less than the paper they're printed on. We're all just stuck in the middle, trying to survive. Then again, maybe I'm the crazy one here. But I doubt it.

Tags: mortgage rates today

Boomtown: What It Is, Casino to Brewery – The Full Picture

Next PostWhy SpaceX's $105M Bitcoin Move Raises Questions (Redditors Assemble!)

Related Articles